Something I’m often asked about when people find out that I’ve been living abroad for a while is, what happens with your taxes? Death and taxes, the only two guarantees in life right? There are a whole lot of variables here that I won’t go into when it comes to taxes, however let’s just say that it’s pretty important to keep up to date with your taxes even if you’re overseas for an extended period of time. Burying your head in the sand and just ignoring them doesn’t work I’m afraid!

Not everyone’s aware that if you’re an American living overseas and earning an income while abroad, that you still need to file your US taxes. Finding qualified help in this area can be something of a problem, especially if you’re somewhere very remote. Not sure if you need to file your taxes for 2018? Check this handy guide out.

So what’s the solution here with taxes for expats? There are services you can find online who can help with the process, so do your research, saying that though, I hear really good things about Taxes For Expats (TFX) so perhaps start there.

So what makes TFX a go to choice for me?

- Expert human help: Deal with real people or use their live support.

- Upfront and fair pricing: Transparent and easy to understand pricing.

- Tried and tested system: After working with thousands of expats over 25 years in 190 different countries, they know what they’re doing.

- Top rated and reviewed firm: TFX have over 800 independent reviews and 5/5 on Trust Pilot.

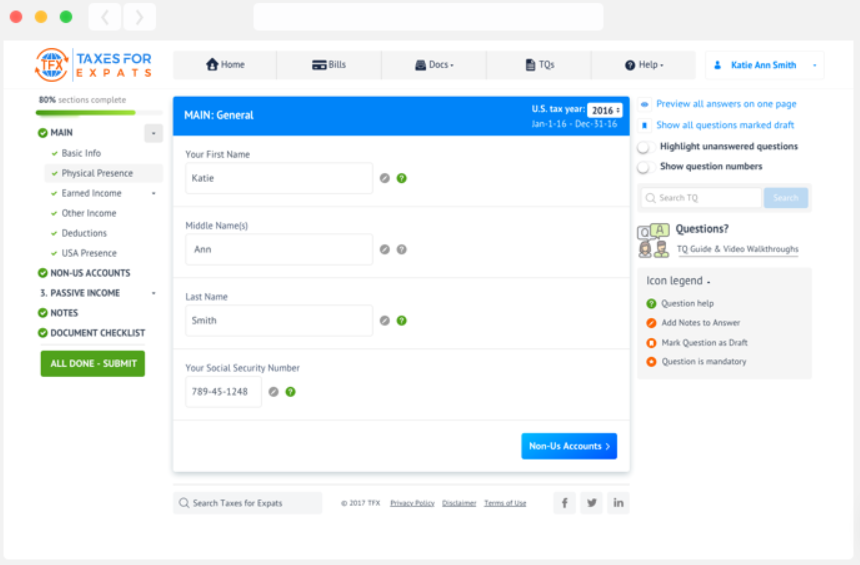

The TFX system is super easy to use and intuitive for new users so there’s no chance you’ll get lost, also they have in their own words: ‘Round the clock fanatical support’ so if you do get stuck, it won’t be for long.

So how does it work? Check out their quick start guide here.

- Register

- They kick things off with a quick (free) 30-minute phone consultation.

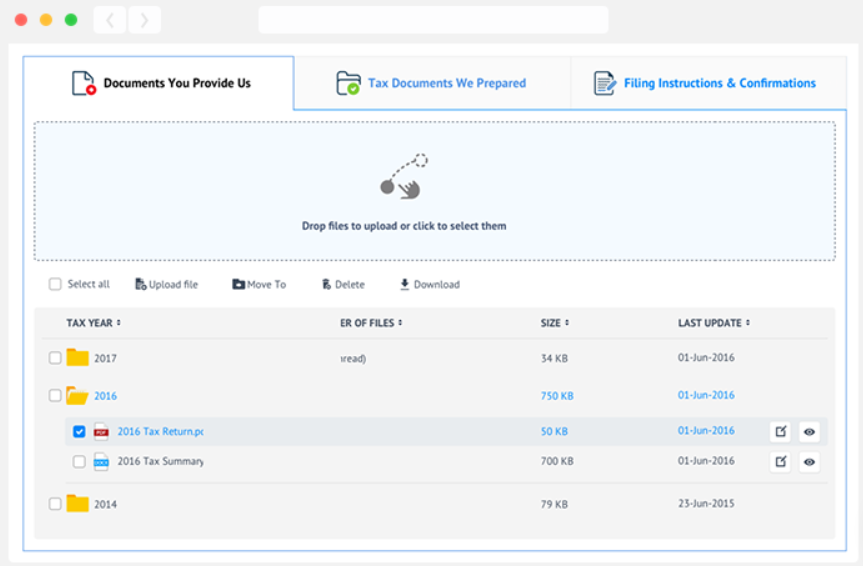

- Then you need to fill in an electronic tax questionnaire to get to know your situation, all done through their secure client portal, so no need for spreadsheets, uploading Word of PDF documents.

- Sign the engagement letter (electronically of course!)

- Then it’s a matter of kicking back, putting your feet up while their team of professionals get to work on your return and once they’re done, review the documents and you’re home dry.

How simple is that? I’m really loving the idea that you can live overseas, literally on the other side of the world and thanks to technology, have access to the same services you could back at home. TFX are exactly that, they offer a great service for Americans overseas and have the track record and reviews to back it up. Check them out or get in touch with them for more info: www.taxesforexpats.com